Understanding how to analyze a business model is crucial for entrepreneurs, investors, and business strategists. Whether you are looking to assess business value, evaluate commercial viability, or compare business models, business model analysis allows you to understand how a company creates, delivers, and captures value.

This guide will walk you through the essential steps and techniques. By the end of this article, you will have a clear understanding of what business model analysis entails, how to read business case studies, and how to effectively evaluate business plans.

What is Business Model Analysis?

Business model analysis is the process of evaluating how a company creates, delivers, and captures value. It involves examining key components of a business model, such as revenue streams, cost structure, customer segments, and value propositions.

The goal is to understand the strengths and weaknesses of the model and identify opportunities for improvement.

How Does a Business Model Differ from a Business Plan?

Before diving into how to analyze a business model, let’s clarify a common confusion: Business Plan vs. Business Model

🔹 A business model explains how a company makes money, covering revenue streams, cost structures, customer segments, and value propositions.

🔹 A business plan is a more detailed document that outlines strategies, financial projections, and operational plans to successfully implement the business model.

Key Differences

| Factor | Business Model | Business Plan |

|---|---|---|

| Purpose | Defines revenue generation and value creation | Detailed roadmap for execution |

| Components | Customer segments, revenue streams, value propositions | Market research, financial projections, operational plans |

| Flexibility | Can evolve dynamically | More structured and detailed |

A strong Business Model Analysis ensures a sustainable and profitable Business Plan.

How to Analyze a Business Model: A Step-by-Step Guide

Evaluating a business model requires a thorough analysis of its internal components, validation through experimentation, market positioning using strategic tools, adaptation to the contextual environment, and strategies to overcome challenges (Anjorin et al., 2024). Regarding this, Schumacher (2022) reported that, from the perspective of German venture capital (VC) investors, a compelling value proposition and a plausible revenue model are the most relevant components of a business model.

Key steps to follow:

Analyze the Fundamental Components

The evaluation should begin by examining the essential components of the business model: value proposition, customer segments, revenue streams, and cost structure. It is crucial to determine whether the value proposition addresses a real market need and whether the revenue streams and cost structure are sustainable and aligned with customer segments.

For example, Sembiring and Sembiring (2024) used a qualitative methodology with a case study approach to analyze the business model of AdventureStock.com in the context of value-based e-commerce. They concluded that the pillars of success include a unique value proposition, active community engagement, environmental sustainability, effective differentiation, and a strong focus on customer satisfaction.

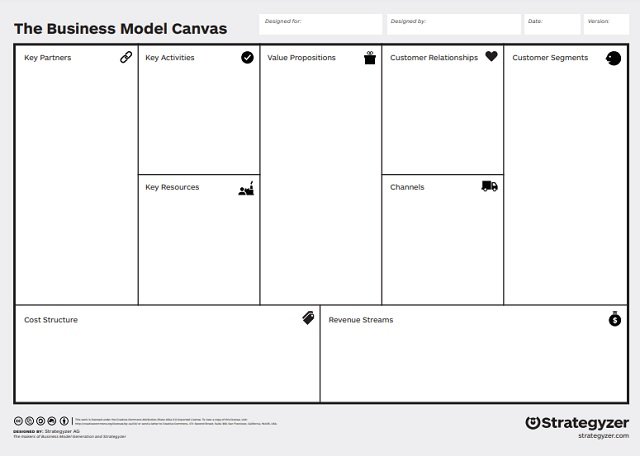

Apply Established Theoretical Frameworks

Frameworks such as the Business Model Canvas (BMC) can provide a structured view of the model by analyzing the interrelationships between its nine key components. Additionally, the Lean Startup Methodology emphasizes the importance of validation through experimentation and validated learning. Evaluating whether the model incorporates iterative development principles and customer feedback is essential.

The BMC consists of nine key building blocks:

1️⃣ Customer Segments – Who are the target customers?

2️⃣ Value Propositions – What problems does the company solve?

3️⃣ Channels – How does the company reach its customers?

4️⃣ Customer Relationships – How does the company interact with customers?

5️⃣ Revenue Streams – How does the company generate money?

6️⃣ Key Resources – What assets are essential for success?

7️⃣ Key Activities – What critical tasks drive operations?

8️⃣ Key Partnerships – What external support strengthens the business?

9️⃣ Cost Structure – What are the main expenses?

For example, Parodos et al., (2022) applied the Business Model Canvas (BMC) to develop a viable business model for Greece’s first on-demand storage platform, the Virtual Freight Center (VFC).

Identify Competitive Advantage

Assessing a company’s unique strengths involves analyzing its market positioning, differentiation strategies, and competitive advantage. Ask:

- Does the company offer a unique product or service?

- How does it stand out from the competition?

- Is the advantage sustainable over time?

Evaluate Business Value

To evaluate business value, it is necessary to assess how effectively the business model generates revenue and manages costs. Review financial metrics such as profit margins, return on investment (ROI), and cash flow.

A profitable company must maintain a healthy balance between revenue and expenses.

- Revenue Streams – Identify primary and secondary sources of income.

- Cost Structure – Analyze fixed and variable costs to determine financial sustainability.

Additionally, consider non-financial factors, such as customer satisfaction and brand reputation.

Analyze Scalability and Growth Potential

Can the business expand without proportional cost increases? A scalable business model should:

✔️ Support rapid expansion

✔️ Maintain or increase profit margins

✔️ Adapt to market changes

Zhang et al., (2022) developed a Big Data-assisted Social Media Business Analysis Model (BD-SMAB) to help decision-makers enhance organizational performance by integrating Big Data and analytics into decision-making processes. This tool can help determine the growth potential of a business.

Conduct a Strategic Analysis

Using strategic analysis tools is essential to evaluate a business model within its context. This includes market research to understand needs and opportunities, competitive analysis to identify market positioning, and tools such as:

- SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats)

- Porter’s Five Forces to understand market dynamics and competitive advantage

- Scenario Planning and Forecasting to prepare for future uncertainties

Consider Contextual Factors

A business model evaluation should account for contextual factors such as industry trends, technological advancements, regulatory environment, and environmental considerations. A relevant and adaptable business model ensures long-term sustainability.

In recent years, the circular economy has become an essential “attribute” of products. Husain et al., (2021) reported that product and process design is the most important business model for implementing a circular economy.

How to Evaluate Business Viability: Key Indicators

A business model may seem solid on paper, but assessing business viability requires deeper analysis. Key indicators include:

Market Demand and Customer Retention

✔️ Is there a consistent market need for the product or service?

✔️ What is the customer churn rate?

✔️ Does the business have loyal customers?

Revenue Sustainability

✔️ Does the company rely on a single revenue source?

✔️ Are there recurring revenue streams (subscriptions, contracts)?

✔️ How stable are its sales projections?

Operational Efficiency and Cost Control

✔️ Can the company scale without excessive costs?

✔️ Are operations optimized for profitability?

A company that scores high in these areas has a sustainable and viable business model.

How to Evaluate Business Value: Measuring Success and Growth Potential

Investors often ask how to evaluate business value before making financial commitments. Valuation depends on:

🔹 Financial Metrics – Profit margins, cash flow, revenue growth

🔹 Brand Strength and Market Positioning

🔹 Customer Lifetime Value (CLV) vs. Customer Acquisition Cost (CAC)

Key Valuation Methods

✔️ Discounted Cash Flow (DCF) – Measures potential future cash flow.

✔️ Market Comparables Analysis – Compares similar businesses.

✔️ Earnings Multiples – Uses revenue/profit multiples to estimate value.

How to Read Business Case Studies: Learning from Real-World Examples

Reading business case studies is an excellent way to learn how to analyze business models. Here’s how to read them effectively:

🔹 Identify the Business Model – Determine the key components of the business model being studied.

🔹 Analyze the Context – Understand the market conditions and competitive landscape.

🔹 Evaluate the Strategy – Assess the strategies used to create and capture value.

🔹 Learn from the Outcomes – Examine the results and key takeaways from the case study.

Business Analysis Modeling: Techniques to Understand Business Performance

Several business analysis modeling techniques help evaluate business models:

✔ SWOT Analysis – Identifies strengths, weaknesses, opportunities, and threats.

✔ PEST Analysis – Examines political, economic, social, and technological factors.

✔ Porter’s Five Forces – Analyzes competitive forces within an industry.

✔ Value Chain Analysis – Assesses activities that create customer value.

✔ Business Model Canvas – Provides a visual framework for mapping a business model.

✔ Balanced Scorecard (BSC) – Measures business performance beyond financial metrics.

Each technique offers a structured approach to evaluating and improving a business model.

How to Analyze a Business Strategy

Analyzing a business strategy involves evaluating long-term objectives and the methods used to achieve them. Key steps:

🔹 Define the Strategy – Understand overall strategy and goals.

🔹 Evaluate Alignment – Ensure strategy aligns with the business model and market conditions.

🔹 Market Positioning – Where does the company stand?

🔹 Assess Execution – Determine how effectively the strategy is being implemented.

🔹 Measure Results – Evaluate outcomes and make necessary adjustments.

🔹 Risk Management – How does the company handle challenges?

A strong strategy aligns business goals with market needs for long-term success.

Conclusion

Knowing how to analyze a business model is essential for entrepreneurs, investors, and business leaders. By applying structured analysis methods, businesses can:

✔️ Identify strengths and weaknesses

✔️ Improve decision-making

✔️ Ensure long-term sustainability

A well-analyzed business model leads to higher success rates, better investment decisions, and sustained profitability. Whether launching a startup or refining an existing business, business model analysis is a crucial step toward success.

References

Anjorin, K. F., Ijomah, T. I., Toromade, A. S., & Akinsulire, A. (2024). Framework for developing entrepreneurial business models: Theory and practical application. Global Journal of Research in Science and Technology, 2(1), 13-28.

Husain, Z., Maqbool, A., Haleem, A. et al. Analyzing the business models for circular economy implementation: a fuzzy TOPSIS approach. Oper Manag Res 14, 256–271 (2021). https://doi.org/10.1007/s12063-021-00197-w

Parodos, L., Tsolakis, O., Tsoukos, G., Xenou, E., & Ayfantopoulou, G. (2022). Business Model Analysis of Smart City Logistics Solutions Using the Business Model Canvas: The Case of an On-Demand Warehousing E-Marketplace. Future Transportation, 2(2), 467-481. https://doi.org/10.3390/futuretransp2020026

Schumacher, N. (2022). Can Business Model Components Explain Digital Start-up Success? A Qualitative Analysis of the Business Models of Start-ups from the Perspective of German Venture Investors. Ekonomska misao i praksa, 31(1), 81-98.

Sembiring, R. A. L., & Sembiring, Y. A. (2024). BUSINESS MODEL ANALYSIS STUDY OF ADVENTURESTOCK.COM : VALUE-BASED APPROACH IN E-COMMERCE. Multifinance, 2(2), 101–107. https://doi.org/10.61397/mfc.v2i2.297

Zhang, H., Zang, Z., Zhu, H., Uddin, M. I., & Amin, M. A. (2022). Big data-assisted social media analytics for business model for business decision making system competitive analysis. Information Processing & Management, 59(1), 102762. https://doi.org/10.1016/j.ipm.2021.102762

Editor and founder of “Innovar o Morir” (‘Innovate or Die’). Milthon holds a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation (UPV) and Market-Oriented Innovation Management (UPCH-Universitat Leipzig). He has practical experience in innovation management, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA) and worked as a consultant on open innovation diagnostics and technology watch. He firmly believes in the power of innovation and creativity as drivers of change and development.