Intellectual Property (IP) has become one of the most valuable assets in today’s knowledge-driven economy. Whether patents, trademarks, copyrights, or trade secrets, understanding the Intellectual property valuation is critical for businesses and investors. However, determining the true value of these intangible assets can be challenging.

An accurate valuation of intellectual property helps in multiple areas, such as mergers, licensing, securing financing, or even in legal disputes. In this article, we will explore what factors affect the Intellectual property valuation, various valuation methods, and why assessing the value of IP is crucial in today’s market.

What is Intellectual Property?

Intellectual property encompasses a set of legal rights that protect creations of the mind, such as inventions (patents), trademarks, industrial designs, literary and artistic works (copyrights), and trade secrets. These rights grant their holders the exclusive right to use, exploit, and license their creations.

What is Intellectual Property Valuation?

Intellectual property valuation refers to the process of determining the monetary value of an organization’s intangible assets, including IP such as patents, trademarks, copyrights, and trade secrets. In this regard, WIPO (?) states that the value of an asset is the value of the future economic benefits it brings.

Unlike physical assets, IP lacks a direct or fixed market value, making its valuation a complex and nuanced process. Accurately determining the value of intellectual property is essential for licensing, litigation, and investment decisions, as it allows stakeholders to assess the true financial value of their IP portfolio.

In the case of a company, the value of intellectual capital lies in the future revenues that the competitive advantage of its commercialization can generate (Su et al., 2023); in this sense, intellectual property should not only create quantitatively significant economic benefits but also enhance the monetary rate of the asset (Ojha & Kumari, 2023).

The Importance of IP Valuation

The need for intellectual property valuation extends across multiple sectors. Startups and technology companies often have more value in their intellectual assets than in their physical ones, underscoring why understanding the value of IP can influence everything from funding rounds to mergers. On the other hand, established companies can leverage IP to create licensing deals, monetize R&D, or enforce legal protections.

In summary, IP valuation is essential in various situations:

- Mergers and Acquisitions: To determine the fair price of a company with a valuable IP portfolio.

- Licensing: To negotiate royalties and establish equitable contract terms.

- Financing: To obtain loans or attract investors.

- Tax Planning: To optimize tax burdens.

- Litigation: To calculate damages in case of rights infringement.

Why is Intellectual Property Valuation Complex?

Owners and operators of intellectual property often need to know an opinion on value, a measurement of damages, or a determination of transfer price regarding their intellectual property (Reilly, 2020); however, valuing intellectual property can be challenging because these are intangible assets with no clear market price or uniform evaluation methodology.

Various factors, such as the legal status of IP, market demand, exclusivity, and technological lifespan, affect its valuation. Additionally, IP can exist at different stages of development, from conceptual patents to market-dominating products, which complicates its evaluation.

Several methods are used to determine the value of intellectual property, but which one is best depends on the type of intellectual property and the purpose of the valuation. Below, we explore the most common approaches.

Methods for Valuing Intellectual Property

Intellectual property, in its various forms, is an intangible that grants rights and economic benefits to its owner; and according to Moro-Visconti (2024), the most commonly used approaches to evaluate intangibles are based on market, income, or cost-related metrics. However, it is important to highlight that approaches to valuing intangible assets are not uniform as each was developed for specific requirements and has a diverse perspective on the subject (Banociova & Bajus, 2023).

According to Puutio (2022), there are two methods for calculating the value of intellectual property: “Relief from Royalty” and “Excess Earnings,” which are based on profit generation; while Priehoda and Havier (2020) report that the basic methods for valuing intellectual property are the cost principle, income principle, comparative principle, and combined principle.

Additionally, Rantasaari (2024) highlights the need for patent valuation guidelines to adopt sustainability as an integral component, ensuring that sustainability and environmentally sound technologies (EST) are integrated into all phases of the patent lifecycle.

Common Valuation Methods

Cost-Based Approach This method calculates the value of intellectual property by determining the costs involved in developing the asset. This includes research, labor, materials, and legal expenses. While this approach is straightforward, it does not account for the actual market demand or the potential income that intellectual property may generate.

Advantages:

- Easy to calculate using existing data.

- Ideal for early-stage intellectual property like a developing patent.

Disadvantages:

- Does not reflect market value or income potential.

- Not suitable for highly dynamic sectors like technology.

Market-Based Approach

This method assesses value by comparing similar intellectual property that has been sold or licensed in the market. For example, when valuing a patent, one could look at the recent sale price of a similar patent.

Advantages:

- Reflects real market conditions.

- Useful for intellectual property that is already commercialized.

Disadvantages:

- Finding comparable assets can be difficult.

- Market prices can be volatile.

Income-Based Approach

This approach estimates future cash flows expected to be generated by intellectual property. This method discounts projected future earnings to the present value using financial models. For example, if you own a patent for a new technology, the method estimates how much income it can generate over its lifetime.

Advantages:

- Provides a forward-looking evaluation.

- Ideal for highly valuable or commercialized intellectual property.

Disadvantages:

- Complex calculations involving assumptions.

- Uncertain income streams make prediction difficult.

Relief from Royalty

Method This is a specific type of income-based valuation where the value of intellectual property is calculated based on hypothetical royalty payments that could be avoided if one owned the intellectual property. This method is commonly used for valuing trademarks and patents.

Advantages:

- Commonly accepted method in intellectual property transactions.

- Accounts for potential licensing income.

Disadvantages:

- Heavily reliant on assumptions about royalty rates.

- Future earnings can be difficult to predict.

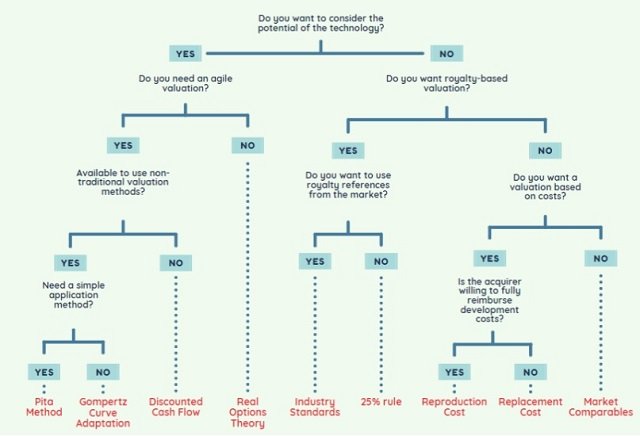

Finally, Cavalcanti et al. (2023) propose a guide for choosing the most suitable method for valuing intellectual property.

How to Value intellectual property: Key Considerations

Banociova and Bajus (2023) highlight that valuing intangible assets is a very difficult task due to the nature of the assets, as it is hard to determine the boundary between intellectual capital and other forms of capital. Therefore, when determining how to value a patent, several factors must be weighed:

- Legal Protection: Is the patent actively enforced? Is it vulnerable to challenges?

- Market Demand: How unique is the innovation, and is there a growing market for it?

- Commercial Potential: What are the potential revenue streams from the patent? Could it be licensed or used to produce market-leading products?

- Remaining Life of the Patent: Patents have a limited lifespan (usually 20 years), so their value decreases as the expiration date approaches.

Factors Influencing IP Valuation

The value of IP depends on several factors, including:

- Nature of the IP: Patents, trademarks, copyrights, trade secrets.

- IP Life Cycle: Introduction, growth, maturity, and decline stages.

- Income-Generating Potential: Market analysis, feasibility studies. In this regard, Su et al. (2023) emphasize that the value of an intellectual property asset varies with the utility it provides to consumers.

- Associated Risks: Competition, technological changes, litigation.

- External Factors: Economic conditions, government policies.

Investing in Intellectual Property

Investing in intellectual property is a key concern for individuals and companies seeking to diversify their portfolios with intangible assets. Investors must evaluate the growth potential, risk factors, and market environment of a particular IP. Licensing opportunities, commercialization possibilities, and litigation protections play a significant role in determining the attractiveness of intellectual property as an investment.

Naim (2024) describes that a successful future for intellectual property financing is an important step in the development of a future intellectual property-based economy. In this sense, companies should conduct audits of their IP to assess how well they capture and manage intellectual property processes.

Intellectual Property Risk Assessment

An integral part of IP valuation is conducting a thorough intellectual property risk assessment. This process identifies potential legal, market, and financial risks that could reduce the value of the intellectual property. Key risks include:

- Legal Risks: Is the patent enforceable, or are there competing claims?

- Market Risks: Could technological advancements render the patent obsolete?

- Operational Risks: Can the company or inventor bring the product to market?

Understanding Intangible Assets and Their Value

While intellectual property is a significant subset of intangible assets, it is not the only one. Intangible assets also include goodwill, brand recognition, and customer lists. A comprehensive valuation of a company often includes these elements to provide a complete picture of the company’s potential value. The line between different types of intangible assets can often blur, so it is essential to categorize and evaluate them correctly in an IP valuation exercise.

Leveraging Intellectual Property Valuation for Business Strategy

Accurate intellectual property valuation can shape strategic business decisions. By understanding the true value of their IP portfolio, companies can:

- License their IP to generate steady income streams.

- Use IP as collateral to secure loans or investments.

- Sell or transfer IP assets in cases of mergers and acquisitions.

- Enforce their IP rights through litigation or negotiations.

In the case of litigation, having an accurate valuation can play a crucial role in legal proceedings, influencing settlement negotiations or the court’s final decision.

Conclusion

In today’s knowledge-based and digital economy, intellectual property valuation has become a cornerstone for understanding the value of intangible assets. Companies, investors, and legal experts rely on accurate valuations to make informed decisions about licensing, mergers, and enforcement actions. Whether you want to understand how to value a patent or conduct an IP risk assessment, it is essential to adopt a comprehensive and nuanced approach to intellectual property valuation.

With methods such as cost-based, market-based, and income-based approaches, along with tools like an IP value calculator, organizations can effectively navigate the complexities of intellectual property valuation. As intellectual property continues to drive economic growth, companies must prioritize the accurate valuation of their intangible assets to capitalize on their full potential.

References

Banociova, A., & Bajus, R. (2023). Methodical approaches to valuation of intangible assets. Acta Tecnología, 9(4), 149-156.

Cavalcanti, L. A., Lepratte, L., Scolaro, M. D. C. M., Gomez , J. B., & Andrade , H. de S. (2023). Evaluation of the main technology valuation methods applied to intellectual property. Revista De Gestão E Secretariado, 14(10), 18864–18888. https://doi.org/10.7769/gesec.v14i10.2873

Moro-Visconti, R. (2024). The valuation of intangible assets: an introduction. In Artificial Intelligence Valuation: The Impact on Automation, BioTech, ChatBots, FinTech, B2B2C, and Other Industries (pp. 41-129). Cham: Springer Nature Switzerland.

Naim, N. (2024). An Examination of the Tangible Value of IP Financing for Companies and Businesses. In Developments in Intellectual Property Strategy: The Impact of Artificial Intelligence, Robotics and New Technologies (pp. 157-179). Cham: Springer International Publishing.

Ojha, P. A., & Kumari, P. (2023). Methods of Valuation of Intellectual Property Assets. NTUT Journal of Intellectual Property Law and Management, 15.

Priehoda, A., & Havier, J. 2020. Intellectual property of a company and valuation of its selected components. Disruptive technologies: regulatory and ethical Challenges, 45-54.

Puutio, A. (Ed.). (2022). Practical guide to successful intellectual property valuation and transactions. Kluwer Law International BV.

Rantasaari, K. (2024). The role of sustainability and SDGs in patent valuation. Maastricht Journal of European and Comparative Law, 1023263X241270285.

Reilly, Robert, Functional Analysis in the Intellectual Property Valuation, Damages, or Transfer Price Measurement (July 22, 2020). les Nouvelles – Journal of the Licensing Executives Society, Volume LV No. 3, September 2020, Available at SSRN: https://ssrn.com/abstract=3658634

Su, R., Li, M., Fang, Y., & Yang, C. (2023). Valuation method of intellectual property pledge financing based on income interval analysis and risk adjustment coefficient. Humanities and Social Sciences Communications, 10(1), 1-10. https://doi.org/10.1057/s41599-023-01897-3

WIPO. ?. IP Valuation. Module 11. 33 p.

Editor and founder of “Innovar o Morir” (‘Innovate or Die’). Milthon holds a Master’s degree in Science and Innovation Management from the Polytechnic University of Valencia, with postgraduate diplomas in Business Innovation (UPV) and Market-Oriented Innovation Management (UPCH-Universitat Leipzig). He has practical experience in innovation management, having led the Fisheries Innovation Unit of the National Program for Innovation in Fisheries and Aquaculture (PNIPA) and worked as a consultant on open innovation diagnostics and technology watch. He firmly believes in the power of innovation and creativity as drivers of change and development.